Carry out a test of significance to determine whether the difference in these sample proportions is convincing evidence of a difference in the population proportions. What conclusion does the test allow you to draw about the population proportions who are unbanked?

Solution.

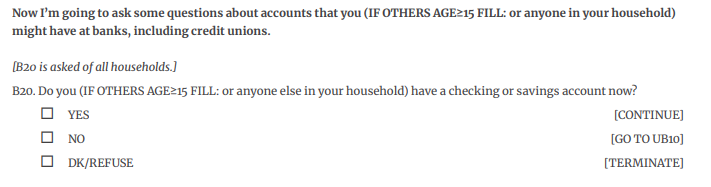

The response variable, whether a household is considered unbanked, is categorical and binary. Suppose we define "success" as "unbanked." Then we can let \(\pi_{white}\) - \(\pi_{Black}\) represent the difference in the population proportions that would be classified as unbanked.

Note: The research question was phrased in terms of "whether there is a difference" so we will use a two-sided test.

The FDIC, like other government surveys, aims to gather a representative sample. Strategies such as weighting and combining results across surveys can also be utilized. In this case, we will treat the White and Black households as independent samples from their respective populations.

The sample sizes are large, so the normal distribution would be a reasonable model for the sampling distribution of the difference in sample proportions. Using this normal distribution model and assuming the null hypothesis is true, we would expect the distribution of the difference in sample proportions to be centered at zero, and our estimate of the standard deviation of this distribution is

\(\sqrt{0.0217(1-0.0217)(1/31653+1/4758)} \approx 0.0023\)

where 0.0217 = (447+342)/(31653 + 4758), the pooled estimate of the proportion of successes.

With this standard error, the observed difference in the sample proportions (0.0141 - 0.0719 = -0.058) is more than 25 standard errors from the hypothesized difference of zero. The probability of observing a standardized statistic at least this extreme (in either direction) by independent random sampling alone is essentially zero.

With such a small p-value (e.g., less than 0.01), we reject the null hypothesis. If the population proportions had been equal, this tells us that there is a very small probability of random sampling alone leading to sample proportions at least as far apart as those found in the FDIC survey. Therefore, we have strong evidence that the population proportion who are unbanked is not the same among Black and White households. A 95% confidence interval for the difference in the population proportions is (-0.0652, -0.0503). So we are 95% confident that percentage of White households is about 5 to 6.5 percentage points lower than the percent of Black households in the U.S. This is not a large difference in a practical sense, but we don’t believe a difference in sample proportions this large could have arisen by random sampling alone (in particular due to the large sample sizes). Note that the imbalance in the two sample sizes really does not negatively impact our comparison of the two proportions.